Prior to implementing a company’s Series A Financing, early stage companies often prefer to raise money by issuing convertible notes or SAFEs (Simple Agreement for Future Equity) as opposed to issuing preferred stock. The primary advantages of issuing convertible notes or SAFEs are that the Company may have separate closings on different dates with individual investors (as opposed to all investors closing on a single date), there are fewer terms to negotiate and there is less paperwork. These advantages allow the financing to be completed more quickly and less costly with respect to transaction fees than a preferred stock financing.

Investors provide capital to the company in exchange for receiving a convertible note or SAFE. Both convertible notes and SAFEs are instruments that convert into preferred stock of the company at a later date when the company sells preferred stock in its next financing. Generally, in order to incentivize investors to make an early investment and take on bigger risk than later investors, the convertible note or SAFE will convert into preferred stock at a discount relative to the price paid by investors in the preferred stock financing. A convertible note is a loan and has a maturity date and interest rate. A SAFE is an equity instrument with neither a maturity date nor an interest rate.

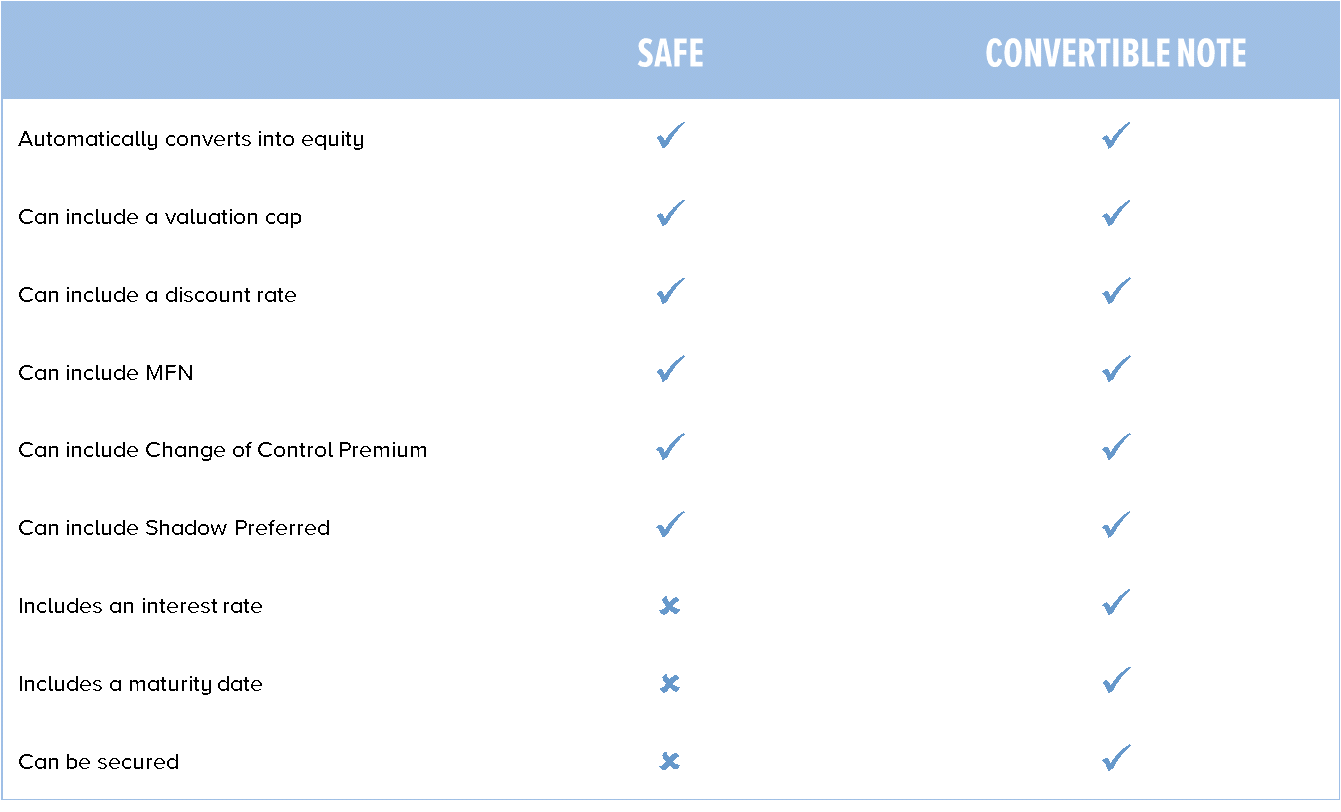

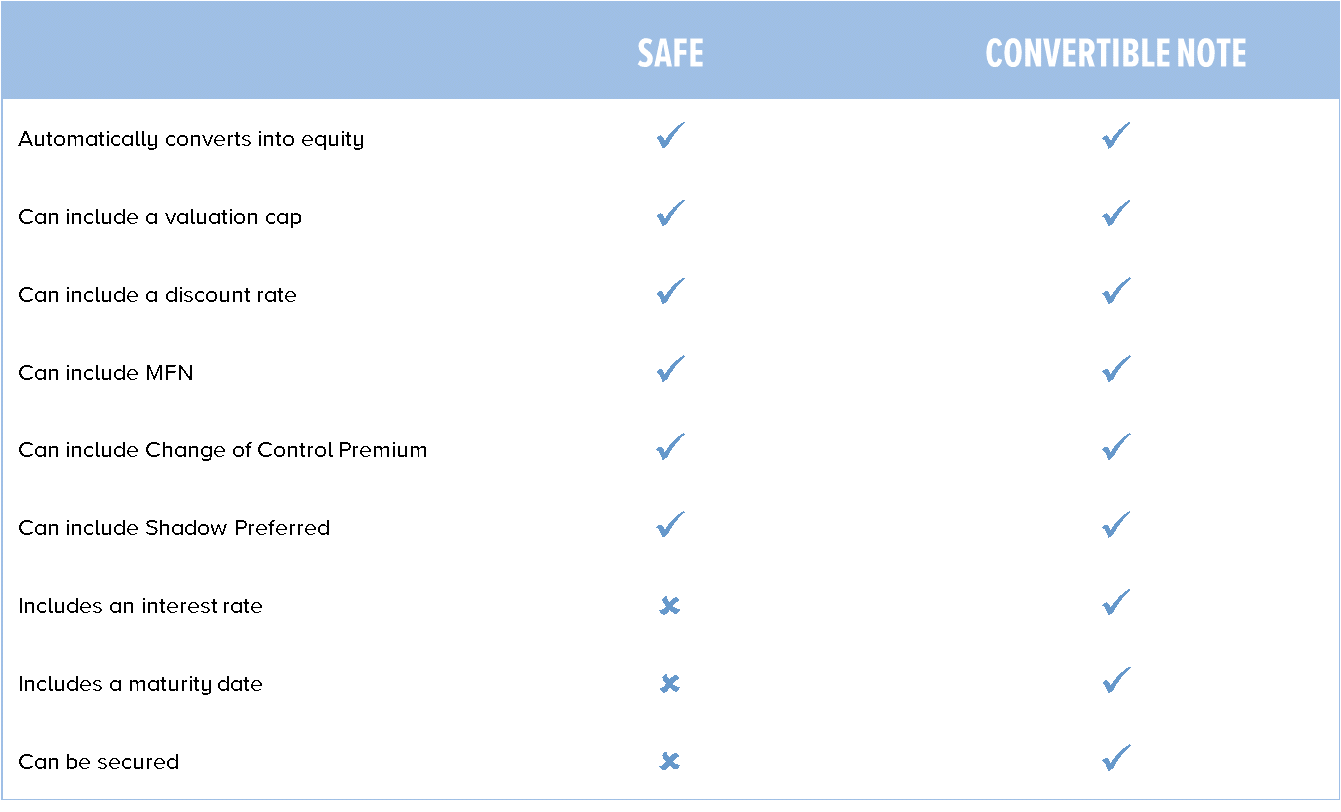

Below is an overview of common terms in convertible notes and SAFEs:

Investors provide capital to the company in exchange for receiving a convertible note or SAFE. Both convertible notes and SAFEs are instruments that convert into preferred stock of the company at a later date when the company sells preferred stock in its next financing. Generally, in order to incentivize investors to make an early investment and take on bigger risk than later investors, the convertible note or SAFE will convert into preferred stock at a discount relative to the price paid by investors in the preferred stock financing. A convertible note is a loan and has a maturity date and interest rate. A SAFE is an equity instrument with neither a maturity date nor an interest rate.

Below is an overview of common terms in convertible notes and SAFEs:

- Conversion to Equity. Both convertible notes and SAFEs are designed to automatically convert into shares of preferred stock when the company completes a priced equity financing (e.g., a Series A Financing). Automatic conversion typically depends on the financing round raising a minimum amount, called a “Qualified Financing.” If the Qualified Financing threshold is not met, the convertible note or SAFE will not automatically convert into equity.

- Discount. Both convertible notes and SAFEs commonly include a provision that the instrument will convert to next round securities at a discount to the price paid by investors in the next equity financing.

- Valuation Cap. Both convertible notes and SAFEs can include the concept of a valuation cap, which is a maximum valuation at which the convertible instrument will convert into equity. A lower valuation cap is more favorable to the investor (i.e., the instrument will convert into a greater number of shares the lower the valuation cap is, assuming the valuation cap is hit). A valuation cap can be calculated pre-money or post-money. A post-money cap is more favorable to the investor.

- Change of Control Premium. Either instrument can include provisions that allow for higher payment in the event of a change of control. This can provide for a payment of, (i) a multiple of dollars of invested, (ii) the amount of cash received as if note converted at the valuation cap or, (iii) the greater of the two.

- Most Favored Nation (MFN) Clause. Either instrument can also include a MFN provision, guaranteeing that existing holders benefit from any terms included in future notes or SAFEs that are more favorable (e.g., a lower valuation cap or a bigger discount rate).

- Shadow Preferred Stock. Convertible notes and SAFEs can convert into shares of “shadow preferred stock” to avoid a situation where the notes or SAFEs convert into preferred stock at a discount while also getting the benefit of the full liquidation preference (essentially multiplying the discount beyond what was negotiated). A series of shadow preferred stock is identical to the preferred stock being sold except that the aggregate liquidation preference of the shadow preferred is equal to the principal amount of the convertible notes or SAFEs.